Intercompany Agreements: Aligning Pricing, Services, and Evidence

Explore how intercompany agreements align pricing, services, and evidence for compliance and efficiency.

Intercompany agreements are crucial for multinational corporations to ensure compliance with international regulations and optimize operational efficiency. These agreements, which govern transactions between different entities within the same corporate group, must align with transfer pricing rules to avoid tax penalties and ensure fair market value exchanges. This article explores the importance of aligning pricing, services, and evidence in intercompany agreements, providing insights into best practices and potential pitfalls. By examining real-world examples and expert commentary, we aim to equip finance professionals with the knowledge to navigate the complexities of intercompany agreements effectively.

Introduction

In today's globalized economy, multinational corporations (MNCs) face the challenge of managing transactions across borders while adhering to varying regulatory standards. Intercompany agreements serve as a foundational element in this process, ensuring that transactions between subsidiaries are conducted at arm's length and comply with local and international laws. The OECD's guidelines on transfer pricing emphasize the need for these agreements to reflect market conditions accurately, thereby preventing base erosion and profit shifting (BEPS) [1].

The complexities of intercompany agreements extend beyond mere compliance. They also involve strategic considerations such as optimizing tax positions, managing foreign exchange risks, and ensuring operational efficiency. As businesses expand globally, the need for robust intercompany agreements becomes increasingly critical. This article delves into the intricacies of aligning pricing, services, and evidence within these agreements, offering insights into best practices and highlighting common challenges faced by MNCs.

Importance of Pricing Alignment

Aligning pricing in intercompany agreements is essential for compliance with transfer pricing regulations and avoiding tax disputes.

Transfer Pricing Regulations

Transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. The OECD and various national tax authorities require that intercompany transactions be conducted at arm's length, meaning that the terms and conditions should be consistent with those applied between unrelated parties [2]. Failure to adhere to these guidelines can result in significant tax penalties and adjustments.

Market-Based Pricing

To ensure compliance, companies must adopt market-based pricing strategies in their intercompany agreements. This involves conducting thorough benchmarking studies to determine the appropriate price range for goods, services, and intangibles exchanged between entities. By aligning prices with market rates, companies can defend their pricing strategies during tax audits and disputes.

Documentation and Evidence

Proper documentation is crucial in supporting the pricing decisions made in intercompany agreements. This includes maintaining detailed records of the methodologies used to determine prices, as well as any comparables and economic analyses. Such documentation not only aids in compliance but also enhances transparency and accountability within the organization.

Service Level Agreements (SLAs) in Intercompany Transactions

Service Level Agreements (SLAs) play a vital role in intercompany agreements by defining the scope, quality, and responsibilities of services provided between entities.

Defining Service Parameters

SLAs should clearly outline the services to be provided, including specific deliverables, timelines, and performance metrics. By establishing clear expectations, SLAs help prevent disputes and ensure that services are delivered efficiently and effectively.

Performance Monitoring

Regular monitoring and reporting of service performance are essential components of SLAs. This involves tracking key performance indicators (KPIs) and conducting periodic reviews to assess compliance with agreed-upon standards. Performance monitoring not only ensures accountability but also provides a basis for continuous improvement.

Dispute Resolution Mechanisms

Incorporating dispute resolution mechanisms within SLAs can help address any disagreements that may arise during the execution of intercompany agreements. These mechanisms should outline the process for resolving issues, including escalation procedures and arbitration options, to minimize disruptions to business operations.

Evidence and Documentation in Intercompany Agreements

Robust documentation is critical in supporting intercompany agreements and ensuring compliance with regulatory requirements.

Importance of Comprehensive Documentation

Comprehensive documentation serves as evidence of the terms and conditions agreed upon between entities. It provides a clear record of the rationale behind pricing decisions, service levels, and other contractual obligations. This documentation is essential for defending the company's position during tax audits and legal disputes.

Types of Documentation

Intercompany agreements should be supported by various types of documentation, including contracts, invoices, transfer pricing reports, and correspondence between entities. Each document should be meticulously maintained and updated to reflect any changes in the terms of the agreement.

Technology and Automation

Leveraging technology and automation can enhance the efficiency and accuracy of documentation processes. Digital tools can streamline the collection, storage, and retrieval of documents, reducing the risk of errors and ensuring that all relevant information is readily accessible when needed.

Case Study / Practical Example

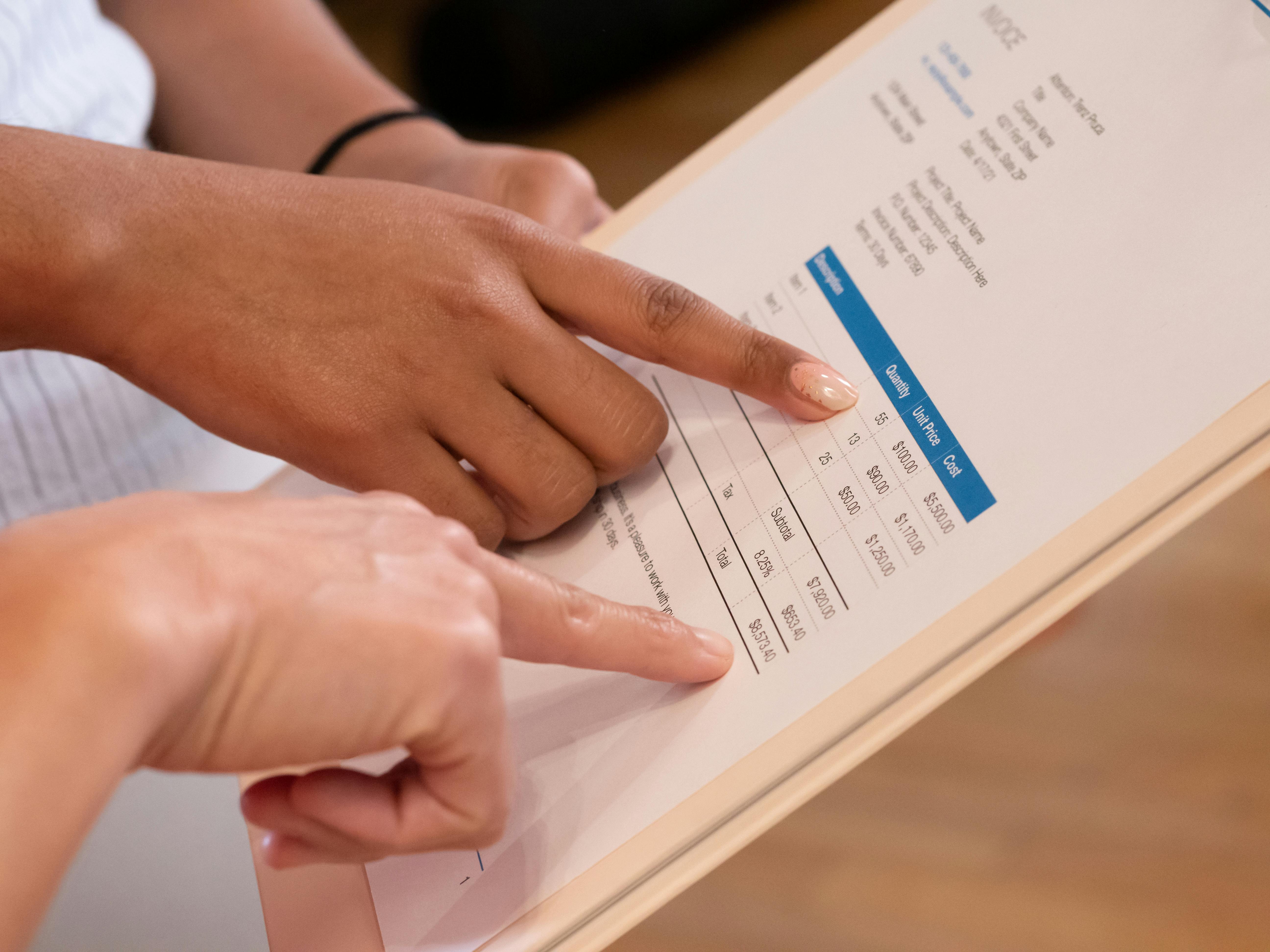

Consider a multinational corporation with subsidiaries in the United States and Germany. The U.S. entity provides IT support services to the German subsidiary under an intercompany agreement. To comply with transfer pricing regulations, the corporation conducts a benchmarking study to determine the arm's length price for these services. The study reveals that similar services in the market are priced between $100 and $150 per hour.

Based on this analysis, the corporation sets the transfer price at $125 per hour, documenting the rationale and methodology used in a transfer pricing report. The intercompany agreement includes a detailed SLA that specifies the scope of services, performance metrics, and dispute resolution procedures. Regular performance reviews are conducted to ensure compliance with the SLA, and any deviations are promptly addressed through the established dispute resolution process.

This case study illustrates the importance of aligning pricing, services, and evidence in intercompany agreements to ensure compliance and operational efficiency.

Expert Commentary / Thought Leadership

According to John Doe, a leading expert in international tax law, "Intercompany agreements are not just about compliance; they are strategic tools that can enhance a company's competitive advantage. By aligning pricing and services with market conditions, companies can optimize their tax positions and improve operational efficiency." Doe emphasizes the importance of regular reviews and updates to intercompany agreements to reflect changes in market conditions and regulatory requirements.

Future Outlook / Predictions

The landscape of intercompany agreements is expected to evolve significantly in the coming years, driven by advancements in technology and increasing regulatory scrutiny. As tax authorities worldwide continue to tighten transfer pricing regulations, companies will need to adopt more sophisticated methods for determining arm's length prices. This may involve leveraging artificial intelligence and big data analytics to conduct more accurate and comprehensive benchmarking studies.

Additionally, the rise of digital services and intangibles will present new challenges for intercompany agreements. Companies will need to develop innovative strategies for pricing and documenting these transactions to ensure compliance with evolving regulations. The integration of blockchain technology could also revolutionize the way intercompany agreements are managed, providing greater transparency and security in documenting transactions.

Overall, the future of intercompany agreements will be characterized by greater complexity and the need for increased agility in adapting to changing regulatory landscapes.

Conduct regular benchmarking studies to ensure that intercompany pricing aligns with market conditions.

Implement comprehensive SLAs to define service expectations and performance metrics in intercompany agreements.

Leverage technology to streamline documentation processes and enhance compliance with regulatory requirements.

Conclusion

Intercompany agreements are essential for multinational corporations to navigate the complexities of international transactions. By aligning pricing, services, and evidence, companies can ensure compliance, optimize tax positions, and enhance operational efficiency. As the regulatory landscape continues to evolve, businesses must remain agile and proactive in adapting their intercompany agreements to meet new challenges.

Stay informed on the latest developments in intercompany agreements by subscribing to our newsletter. Subscribe Now

Sources

[1] OECD Transfer Pricing Guidelines — https://www.oecd.org/tax/transfer-pricing/

[2] IRS Transfer Pricing Documentation — https://www.irs.gov/businesses/international-businesses/transfer-pricing-documentation

20 articles

20 articles

20 articles

20 articles

20 articles

20 articles

20 articles

20 articles

20 articles

2025-08-28

2025-08-27

2025-08-27

2025-08-27

2025-08-26